Regal Imports News

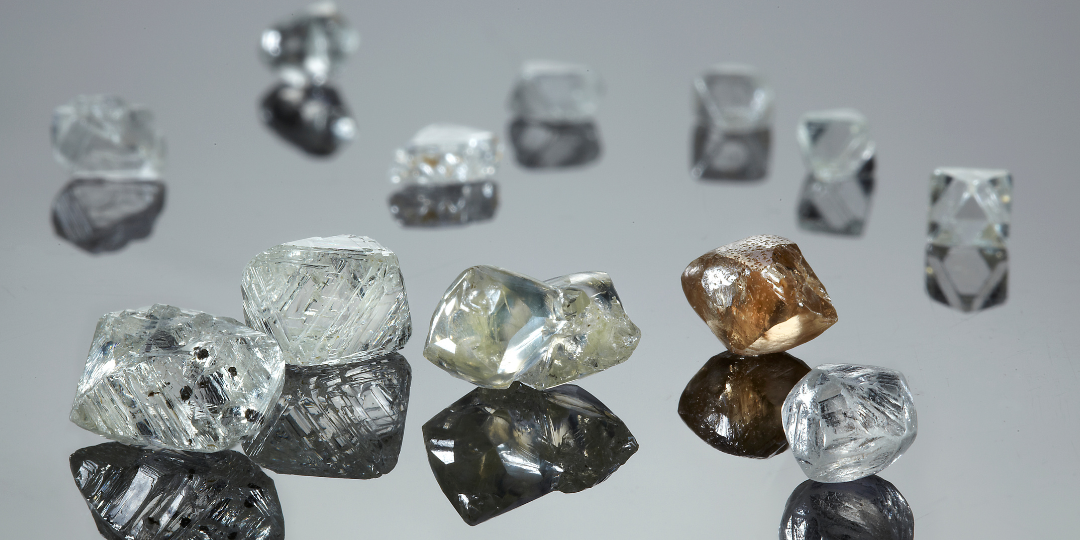

Canadian Diamonds: Yesterday, Today and Tomorrow - April 2025

As a matter of clarification, Canadian wholesalers and retailers, selling in Canada, are not affected directly by U.S. tariffs on rough and polished diamonds. They are, however, indirectly affected by the US tariffs on global diamond sales.

The current global diamond crisis began with Russian diamond sanctions, then the collapse of the Chinese economy, followed by competition from manufactured diamonds, slumping diamond prices, and finally the recent introduction of tariffs on diamonds entering the United States.

How does all of this affect Canadian diamonds?

The health of Canadian diamond industry does not dependent on the sale of Canadian diamonds in Canada. Canada consumes only a very small portion of these diamonds.

The decreased prices and sales of all natural diamonds are dramatic, and all miners are cutting production while some mines are closing. I reported last month that all the major diamond mining projects are struggling and losing copious amounts of money.

The USA accounts for 50% of all polished diamond sales. Country of origin, according to U.S. tariff regulations, is the last place of substantial transformation. So, a diamond mined in Canada but cut in India, is considered to originate in India not Canada, and is subject to the high US tariffs applied to India.

China which used to be the second largest diamond market, is becoming a dead market for diamonds, and the United States, the largest diamond market is applying tariffs to almost all diamonds entering the country.

CBC News in Yellowknife reported that inflation, slumping diamond sales and lower prices for both rough and polished diamonds are contributing to the huge losses reported by all Canadian diamond mining projects. CBC also draws attention to the short time left in the lifespan of the three major diamond mines in the Northwest Territories. They speculate that Canadian mines could start to close if economic turbulence continues.

The introduction of US tariffs has brought the global diamond market to ‘a complete standstill’. The World Diamond Council maintains that if there are no changes to US tariff rules, then the whole diamond industry will face ‘a considerable risk’. The website ‘Rough and Polished’ states, that if tariff levels are not negotiated down then “the market of natural diamonds in the US, followed by the global polished diamond market, will simply lose its breath.”

Canadian diamonds have been a lucrative part of the Northwest Territories economy since 1987. Diavik is scheduled to close in early 2026, Ekati in 2029, and Gahcho Kue in 2030. There is not much life left in these mines and, if there is no change in the trajectory of US tariffs and diamond sales, then it is quite possible that the owners of the diamond mines of northern Canada may just cut their losses and close.

Mel Moss