Retailers are essential - September 2024 News

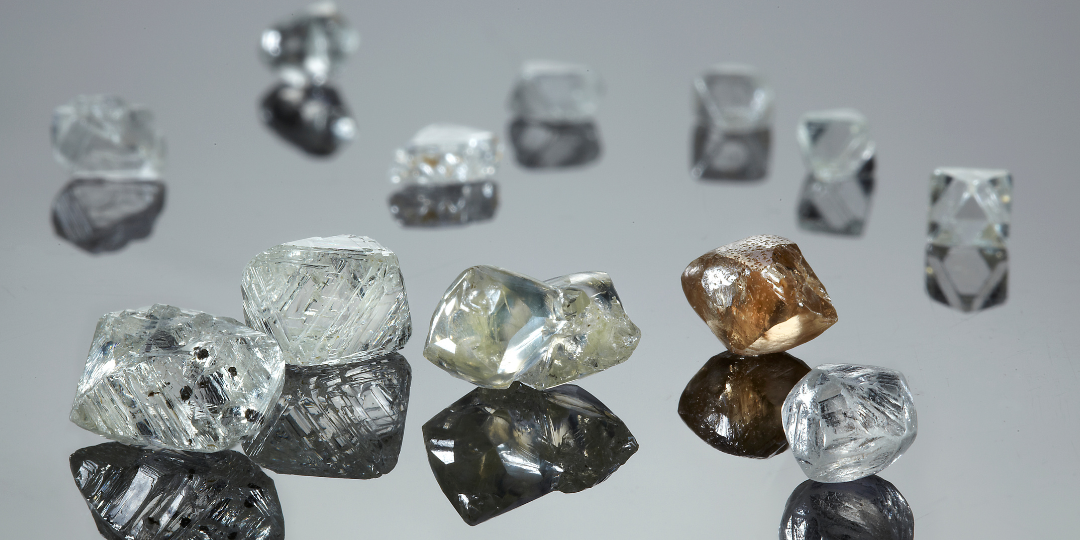

Finding a diamond bearing deposit and then developing it into a diamond mine is a very expensive and time-consuming proposition. Permits are needed, ecological viability needs to be assessed, diamonds need to be brought forth in sufficient quality and quantity to make the project viable. Developing a mine site can take 10 years before any returns are realized, and escalating labour and equipment costs are making a profitable mining project a real challenge.

Like every successful business, mines must return a profit. Currently, the only thing that is keeping some diamond mines above water is the discovery of extra-large diamond rough. Most mining operations cannot absorb many more price decreases before they become impractical.

Diamond prices have reached a threshold where miners must reduce rough supply to curtail falling prices. They can only implement a limited number of stop gap measures. They can dump their stock and remain financially fluid, or they can decrease supply to stabilize the market. Some larger mining concerns are scaling back operations while weaker mines are simply closing operations. Rough sales have dropped 22% in the first half of 2024 and large stockpiles are building up.

In late August there were line ups at the rough tenders in Dubai. It could be construed that some miners are having cash flow problems and are dumping rough. This situation could further disrupt the balance of supply and demand. It warrants industry’s attention.

Diamond cutters are holding the line on rough purchases because they have excessive quantities of both rough and polished diamonds and are losing money as they try to sell into a market with depreciating demand and prices.

Idex reports that” Overall sentiment remains cautious, with (most) manufacturers maintaining polished production at reduced levels and working short weeks due to sluggish demand.” Retailers are understandably nervous about the decreasing price of polished natural diamonds. Many have chosen not to purchase polished diamonds and prefer to take them, as needed, on memo.

Reducing diamond supply has worked many times in the past, but the current situation is more serious, as polished diamond prices have fallen faster and more drastically than any time in history. This radical change in value has caused a dangerous loss of confidence in natural diamonds as a precious commodity.

If natural diamonds are to regain market share, it will be due to the hard work of retailers more than on the profit losing restraints of miners and manufacturers. If retailers feel confident enough to buy natural diamonds and professionally promote them, then consumers will buy them. The opposite also holds true, if the retailer sector has no faith in natural diamonds, then consumers will follow their lead and move away from the product. The rise or fall of natural diamonds is really just that simple.

The most essential players in the promotion and success of natural diamonds are those retailers who honestly understand and appreciate diamond worth and history and can convey that understanding to their staff and clients with confidence.

Mel Moss