Regal Imports News

The Juice is Worth the Squeeze - June 1st, 2025

Diamond demand was muted at the De Beers May sight and Russia reported a 42 percent slump in First Quarter sales. Such is the world of diamonds.

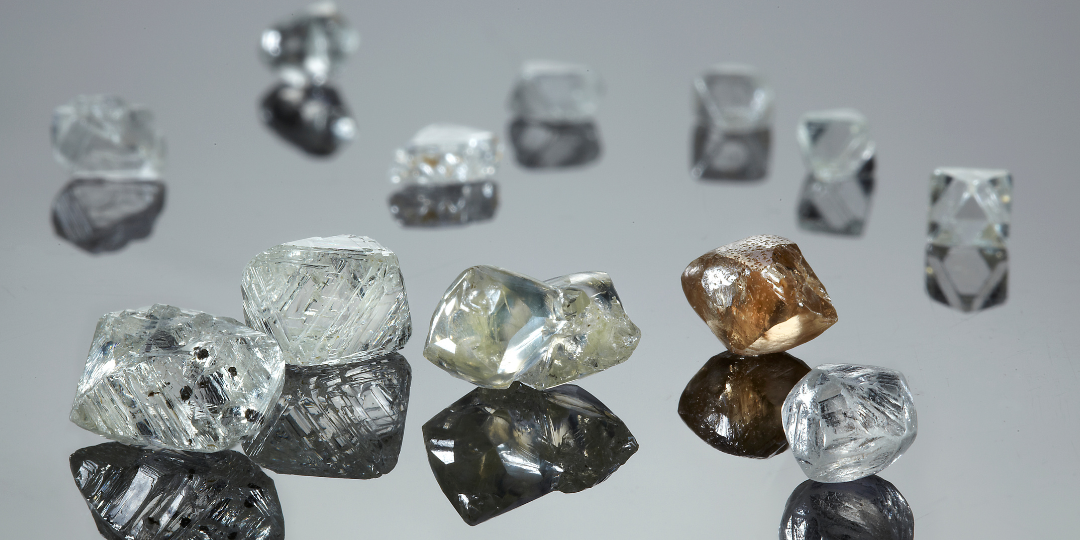

Botswana is the largest producer of ‘unsanctioned’ diamonds. Diamonds are the Botswana’s most important export. They have contributed to making the country’s economy one of the most successful in Africa.

However, Botswana’s diamond exports fell 41% in 2023, another 26% in 2024 and have continued their drastic fall into 2025. The Canadian diamond miner Lucara, who owns the Karowe mine in Botswana, does not know whether it can survive through 2025. Even worse, Botswana’s president has announced that he is terminating over one thousand jobs at Debswana, the government’s joint mining venture with De Beers. Botswana's credit has been downgraded by multiple rating agencies, and the country has negotiated a one-billion-dollar support package from the African Development Bank.

Lucapa Diamonds, an Australian-listed diamond mining company, which owns the Lulo Mine in Angola, has entered voluntary administration and is exploring restructuring or selling out. The Australian Securities Exchange has suspended Lucapa, saying that its “financial condition is not adequate to warrant the continued quotation of its securities.”

Petra Diamonds, who operate the Cullinan Mine in South Africa, is restructuring and trying to refinance its’ 258-million-dollar debt. In the face of all these hard facts, it appears that every participant in the diamond mining sector, including all Canadian mines, are feeling the effects of sustained low prices and high operational costs.

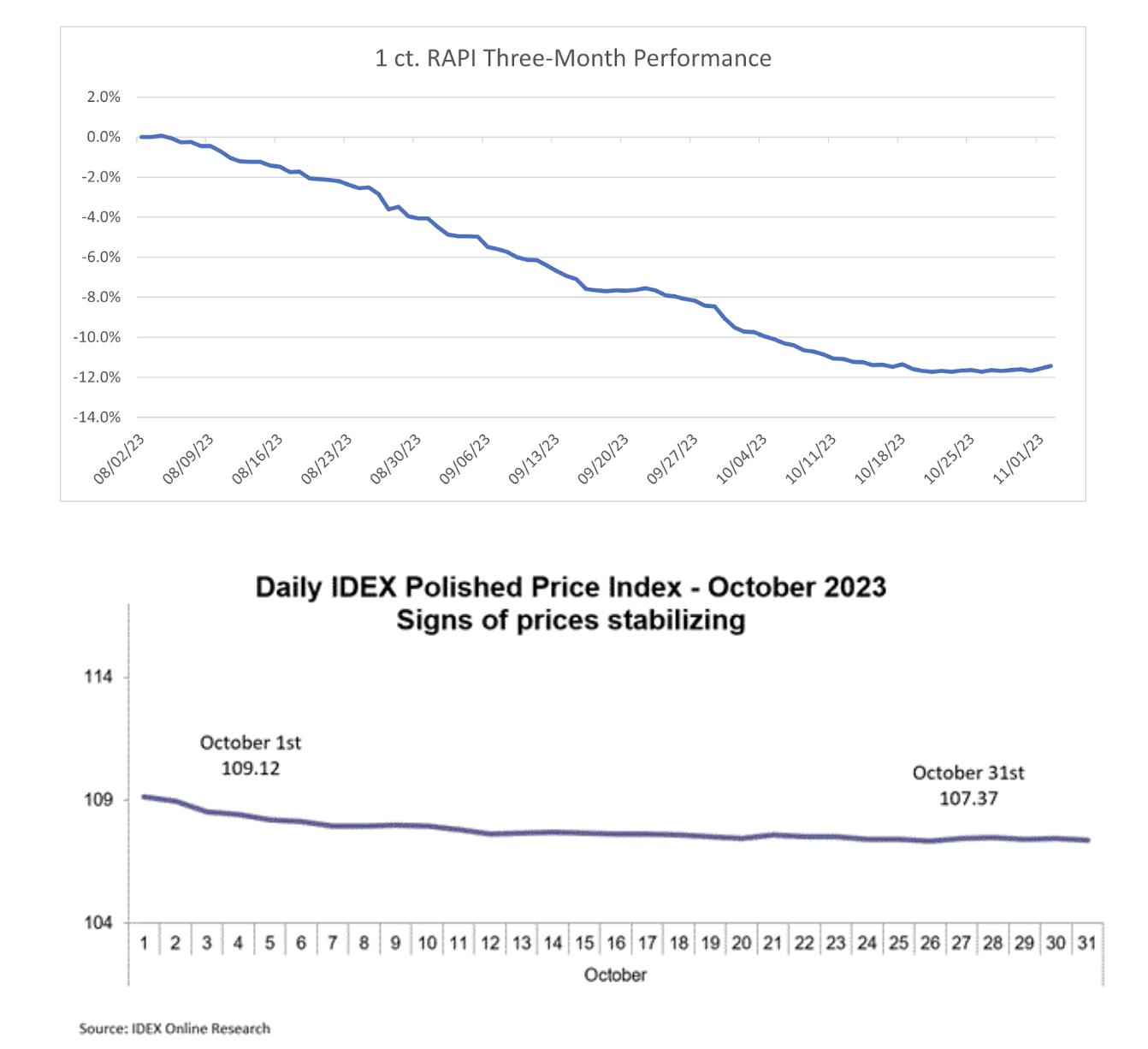

There is a point that can be clearly demonstrated from all these mining misfortunes. It is that there is a definitive base cost to making it in the mining business. When the cost of mining is higher than the selling price, mining discontinues. It is clear that under current financial mining conditions, the cost of mining natural diamonds is exceeding their potential selling price; simply, natural diamond prices have hit rock bottom. Barring the complete destruction of natural diamond demand, natural diamonds will rise, either due to scarcity, due to mine closures, or from an increase in demand.

Inflation and tariff unpredictability are leading to retail consumer hesitancy. This does not bode well for the Vegas show. Regal Imports is progressing positively but with caution, while cutting expenses wherever possible. Natural diamond sales are slow and diamond related companies with too many expenses will suffer.

Significant improvement in the diamond market is dependant on a well-defined change in attitude. An attitude built upon the desire of jewellery industry participants to keep natural diamonds on the pedestal, where they inherently belong.

As Richa Singh of the Natural Diamond Council eloquently explains “Natural diamonds are not just a purchase — they are a milestone, a memory, a story. They connect generations. Natural diamonds are emotional treasures — deeply personal, enduring, and timeless. A symbol of love … A connection across generations” …... Allow me to simplify these thoughts, even more, gramma’s engagement ring does not have a replacement value. Gramma’s diamond is timeless and priceless, because it is authentic, natural, and has a history; it is not subject to the constraints of style or taste. Each individual natural diamond has the potential to become irreplaceable. This simple message is the truth and is waiting to be communicated in a fresh and relevant fashion, to a younger generation that has been deprived of this essential information.

Mel Moss